Explain how interest income is deemed to be derived from Malaysia under the Income Tax Act 1967. 21st October 1971 _____ ARRANGEMENT OF SECTIONS _____ Long Title PART I - PRELIMINARY Section 1.

Laws Of Malaysia Income Tax Act 1967 Revised 1971

Unannotated Statutes of Malaysia - Principal ActsINCOME TAX ACT 1967 Act 53INCOME TAX ACT 1967 ACT 53Schedule 5.

. ACT 53 INCOME TAX ACT 1967 REPRINT - 2002 Incorporating latest amendments - Act A11512002. 1 Every appeal shall be heard by three Special Commissioners at least one of whom shall be a person with judicial or other legal experience within the meaning of. 10 marks 5.

Revised up to. Charge of income tax 3 A. Schedule 5 Section 102 Appeals.

Under Section 60E of the Income Tax Act 1967 income derived by an approved OHQ company is given a tax concession from the provision of qualifying services in respect of. Unannotated Statutes of Malaysia - Principal ActsINCOME TAX ACT 1967 Act 53INCOME TAX ACT 1967 ACT 532Interpretation. AUTHORITY OF THE REVISION OF LAWS ACT 1968 IN COLLABORATION WITH MALAYAN LAW JOURNAL SDN BHD AND PERCETAKAN NASIONAL MALAYSIA BHD 2006 Act 53 INCOME TAX ACT 1967 Incorporating all amendments up to 1 January 2006 053e FM Page 1 Thursday April 6 2006 1207 PM.

Reference to the updated Income Tax Act 1967 which incorporates the latest amendments last updated 1 March 2021 made by Finance Act 2017 Act 785 can be accessed through the Attorney Generals Chamber Official Portal at the following link. Or Income Tax Act 1967. The Income Tax Act 1967 ITA enforces administration and collection of income tax on persons and taxable income.

Procurement of raw materials components and finished products. 5 marks b Provide any four 4 actions that is considered as wilful evasion by the tax authorities in. INCOME TAX ACT 1967 ACT 53 SCHEDULE 6 - Exemptions From Tax.

Crowe Chat Vol82020 Crowe Malaysia PLT SUBTITLE 24. Income tax rules and legislative notifications have been reproduced or summarised in an easy-to-read table format. 1 This Act may be cited as the Income Tax Act 1967.

Laws of malaysia reprint published by the commissioner of law revision malaysia under the authority of the revision of laws act 1968 in collaboration with malayan law journal sdn bhd and percetakan nasional malaysia bhd 2006 act 53 income tax act 1967 incorporating all amendments up to 1 january 2006 053e fm page 1 thursday april 6 2006 12. PART I INCOME WHICH IS EXEMPT. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1.

General management and administration. Short title and commencement 2. 2 days agoIn Malaysia income tax is charged based on income accruing in derived from or received in the country as stated under Section 3 of the Income Tax Act 1967 ITA.

The income of the Government or a. A Explain the methods of reporting or submitting taxs working sheets through the IRBM XBRL Submission System. Unannotated Statutes of Malaysia - Principal ActsINCOME TAX ACT 1967 Act 53INCOME TAX ACT 1967 ACT 53Schedule 5.

Schedule 5 Section 102 Appeals. The official emoluments of a Ruler or Ruling Chief as defined in section 76. Code of Ordinances Prince Section 241a Income Tax Act 1967 - englshbda Section 24 1a Income Tax Act 1967 39.

Business planing and co-ordination. However certain types of income specified in Schedule 6 of the ITA such as foreign source income as per paragraph 28 of Schedule 6 are exempt from income tax. Short title and commencement.

Non-chargeability to tax in respect of offshore business activity 3. Income Tax Act 1967 Revised 1971 LAWS OF MALAYSIA. And there are parts which have been customised to ensure adherence to the Act and Inland Revenue Board of Malaysias IRBM procedures as well as domestic circumstances.

Finance Act 2018 had introduced a new Section 140C to the Income Tax Act 1967 ITA to restrict the deductibility of interest expenses incurred by a person in respect of his business income in certain circumstances. 1 Every appeal shall be heard by three Special Commissioners at least one of whom shall be a person with judicial or other legal experience within the meaning of. The Inland Revenue Board of Malaysia IRBM is one of the main revenue collecting agencies of the Ministry of Finance.

Restriction On Deductibility Of Interest under Section 140C of the Income Tax Act 1967 and Income Tax Restriction On Deductibility Of Interest Rules 2019 PU. Unannotated Statutes of Malaysia - Principal ActsINCOME TAX ACT 1967 Act 53INCOME TAX ACT 1967 ACT 5321Basis period of a person other than a company limited liability partnership trust body or co-operative society. Malaysia Income Tax Act 1967 with Complete Regulations and Rules is appropriate for practitioners to use in court practical as a desk or portable reference and reliable as a student text.

47 of 1967 Date of coming into operation. That reciprocal treatment is accorded by that country to persons exercising corresponding functions in the service of Malaysia. The Income Tax Act 1967 provides that where a person referred herein as payer is liable to make payment as listed below other than income of non-resident public entertainers to a non-resident person NR payee he shall deduct withholding tax at the prescribed rate from such payment and whether such tax has been deducted or not pay that tax to the Director General.

Section 241a Income Tax Act 1967 - englshbda Crowe Chat Vol82020 Crowe Malaysia PLT Societies Free Full-Text Strong Welfare States Do Not. 3 This Act shall have effect for the year of assessment 1968 and subsequent years of assessment. Federal Legislation Portal Malaysia.

Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3. This page is currently under maintenance. 28 September 1967 BE IT ENACTED by the Seri Paduka Baginda Yang di-Pertuan Agong with the advice and consent of the Dewan Negara and Dewan Rakyat in Parliament assembled and.

An Act to impose a tax upon income from the winning of petroleum in Malaysia to provide for the assessment and collection thereof and for purposes connected therewith.

Taxation In Malaysia 2020 1 Although The Income Tax Chegg Com

Introduce Of Malaysian Taxation By W Q

Laws Of Malaysia Income Tax Act 1967 Revised 1971

Chapter 1 Introduction To Malaysian Taxation Flip Ebook Pages 1 19 Anyflip

Chapter 1 Introduction To Malaysian Taxation Flip Ebook Pages 1 19 Anyflip

How Much Does It Cost To Develop A Law Firm Mobile App Development

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Best Payroll And Tax Services In Switzerland

Laws Of Malaysia Income Tax Act 1967 Revised 1971

Income Tax Act 1967 Act 53 With Selected Regulations Rules As At 10th April 2022 Shopee Malaysia

St St Partners Plt Chartered Accountants Malaysia

Malaysia Income Tax Act 1967 With Complete Regulations And Rules 9th Edition Taxation New Releases

Malaysia Income Tax Act 1967 With Complete Regulations And Rules 10th Edition 9789672875062 Booklinks

Chapter 8 Tax Administration Flip Ebook Pages 1 14 Anyflip

Capital Vs Revenue Crowe Malaysia Plt

Petronas And Others Appeal Near 900m Malaysia Tax Bill Upstream Online

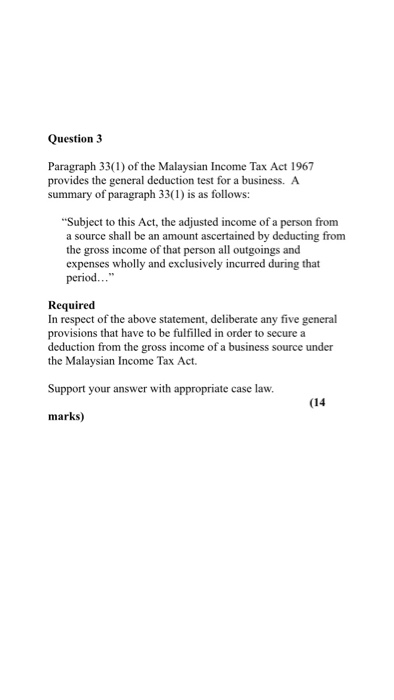

Solved Question 3 Paragraph 33 1 Of The Malaysian Income Chegg Com